The UK is battling skyrocketing food, fuel and energy costs. With the cost of living increasing, it is key for employers to support their staff by providing educational awareness around personal financial wellbeing (1).

Most businesses are not fully aware of the role financial wellness plays in overall health and wellbeing. Most people have experienced the effects of financial worries at one time or another in their lives, but understanding how anxiety related to finances affects our overall health is not always considered. Financial stress can lead to mental and physical health problems (34% and 23% respectively). It also has a direct impact on an individual’s productivity at work in one out of five cases (2).

The Chartered Institute of Personnel Development (CIPD) annual report on health and wellbeing and a separate focused financial wellbeing study shows that:

- Only half of organisations (51%) take a strategic approach to employee wellbeing (3).

- Health and wellbeing activity most commonly focuses on mental health (60% (4)) but many also make some effort to promote values/principles, collective/social relationships, good work (for example, job design, work–life balance) and physical health.

- There is considerable variation in the extent to which organisations include specific wellbeing provision for particular groups of employees (such as carers) or issues (such as bereavement, suicide risk and prevention, chronic health conditions or good sleep hygiene). Only a minority include provision for issues such as women’s health and men’s health.

- Financial wellbeing remains the most neglected area of overall health and wellbeing education and support. Only 11% of companies, which have a health and wellbeing strategy in place, focus on financial wellness (4).

• Where HR teams have begun owning the cause for promoting a health and wellbeing strategy for employees, it is important for them to understand the impact of financial wellness and education and become champions for the same. Addressing these issues can help companies become more profitable as there is a strong correlation between financial stress and loss of productivity (4).

How Thrive4Life can help you promote Financial Wellbeing

Providing employees with financial wellbeing tools improves their quality of life, productivity at work and commitment to their companies.

Thrive4Life are hosting regular talks on financial wellbeing, designed for employees. The next talk is due to run on Friday 19th August 2022 at 12.30pm. Our speaker, Professor George Callaghan, is a Professor of Economics and Personal Finance and a certified Executive Coach. Professor Callaghan will address listeners’ money concerns by providing the knowledge, tools and techniques required to build positive money habits.

The webinar will begin by setting out the context of money, including how the present cost of living crisis impacts on individuals and their households. Professor Callaghan will then explore the important role of money emotions and money psychology, before moving on to practical strategies and tactics for developing positive money habits.

You can also benefit from some wonderful advice from Professor Callaghan in his blog at www.positivemoneyhabits.co.uk/blog

What is Financial Wellbeing

While there are a few different definitions of what financial wellbeing entails, at the most basic level it refers to a lack of stress due to one’s financial position. Addressing this is an immediate concern, as over half of all UK employees below an intermediate managerial position say they face either temporary or permanent troubles paying their bills (4).

Business Impact of Poor Financial Wellbeing Support

We cannot ignore the increasing importance of investing in a financial wellbeing strategy, which should form part of an organisation’s portfolio for the provision of a well-rounded health and wellbeing staff offering. An organisation that shows its employees that it cares about all aspect of their staff’s health will ultimately improve productivity, through reducing absenteeism and presenteeism and supporting recruitment and retention.

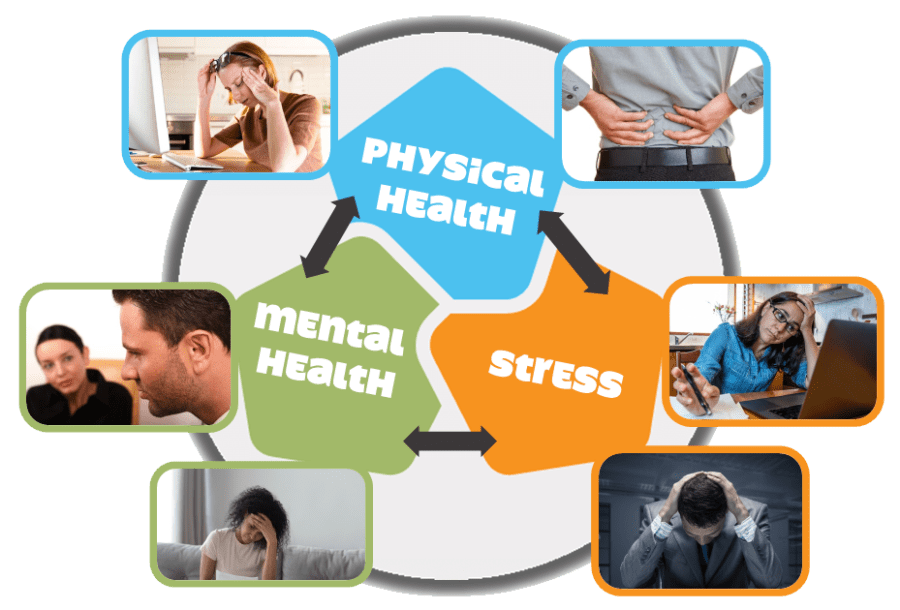

The close links between stress, mental health and physical health

There are very close links between stress, mental health and physical health. They form a triad of interconnecting cause and effect.

It is widely known that prolonged stress can cause or exacerbate mental ill health and physical illness. Chronic or long-term stress is often a pre-cursor to anxiety and depression. Stress is also linked to a higher risk of many physical health conditions, including musculoskeletal problems, high blood pressure, heart disease, cancer, to name but a few.

Most people can relate to the fact that a physical health condition can make you feel stressed and lead to poor mental health, whether it be through feeling pain or discomfort or the sheer worry of the physical illness (waiting for test results, going through treatment, the worry of a family member being ill, etc).

It can also work the other way, if you have anxiety or depression, it can affect your physical health with muscle tension, suppression of your immune system and prevent you from looking after yourself physically.

Stress, poor mental health and poor physical health can all feed each other. Understanding this critical triad leads us to appreciate how financial concerns, which feeds mental stress, can exacerbate this negative cycle.

Given how financial insecurity can lead to stress and poor mental health, this clearly highlights the importance for the inclusion of financial wellness into your health and wellbeing offering.

How to promote financial wellbeing

Highlight your financial benefits

One of the simplest and most cost-effective ways to promote financial wellness is to ensure that your employees are aware of the financial benefits and resources that are available to them.

Provide financial webinars and education

Providing financial webinars and well-researched content on the basics of personal finance is extremely helpful. While it may not immediately result in improved financial wellness, it can pause its deterioration. Research has proven that developing soft skills and good behaviour around money are more important than dry facts about retirement funds or saving plans. As mentioned above, Thrive4Life are running a live financial wellbeing webinar on Friday 19th August 2022. Visit our event page for more info and to book access for your company.

One to one, or small group, financial wellbeing coaching

One to one and small group coaching gets to the nub of issues and catalyses participants to take action.

Financial wellbeing supports diversity and inclusion

Promoting employee financial health can also help an organisation promote its diversity and inclusion strategy from multiple angles, for example:

- Assisting graduate starters understand how to manage their finances, as they begin their working life.

- Supporting disadvantaged groups, who often struggle the most with financial issues.

Employee engagement in financial wellbeing initiatives shows improved mental health particularly for those in lower income groups (5).

It is vital to remember the importance of offering a diversity of resources as people at different stages of their lives may require greater or lesser support.

The Money and Pensions Service of the UK has found a high degree of correlation among a person’s financial wellbeing and how content they feel with their lives, even more than those earning some of the highest salaries do (6).

Building a successful financial wellbeing strategy for your company

As this article has shown, HR teams must become vocal champions in building impactful financial wellness programmes as a crucial contributor to supporting staff fully in health and wellbeing.

Financial wellbeing education doesn’t have to be expensive!

Companies can share information about free financial wellness resources available to their employees. The Couch to Financial Fitness is a free online programme is available on the MoneyHelper website in the UK. It provides a weekly guide to help people get on track and in control of their finances.

Thrive4Life Health and Wellbeing Discovery Hub

Financial education is often forgotten over time and needs reinforcing regularly. Another way of providing on-demand learning is via the Thrive4Life Health and Wellbeing Discovery Hub, a resource that provides a cost-effective route for employees to access ongoing education in health and wellbeing. Contact us for further information.

Further Resources

- The MoneyHelper website offers several free tools and resources to aid financial wellbeing. These cover several financial requirements such as pension, debt and money advice.

- This Money Skills course by MRU covers the basics of saving and investing. Two seasoned economists bring you the information you need to start planning your finances. It is a great place to get started with your financial planning journey.

Reminder – Upcoming live webinar on Financial Wellbeing

Friday 19th August @ 12:30pm

References:

- “What is the UK’s inflation rate and why is the cost of living going up?” BBC, 23 June 2022.

- “2022 PwC Employee Financial Wellness Survey”

- CIPD Report 2022

- Gifford, J., Cotton, C. and Young, J. (2021) Financial wellbeing: an evidence review. Practice summary and guidance.

- Kuchler, Hannah. “Employers urged to help workers navigate stresses of cost of living crisis.” Financial Times, 6 July 2022.

- “Beat the blues by focusing on financial wellbeing” Money and Pensions Service, 17 January 2022.